CompatibL Risk Cloud

CompatibL designs and implements front-office, mid-office and back-office software for strategy, asset and risk management, utilizing the best market practices, quantitative algorithms and technical architecture.

The risk management software by CompatibL can be deployed in your data center or private cloud and in most public clouds, including AWS and Azure. When deployed in the cloud, it leverages the latest serverless cloud technologies, including AWS Fargate, Lambda, Step Functions and Azure Functions. Our platform also supports both Windows and Linux traditional data centers and can run on top of all leading cluster management software solutions.

Get the Report

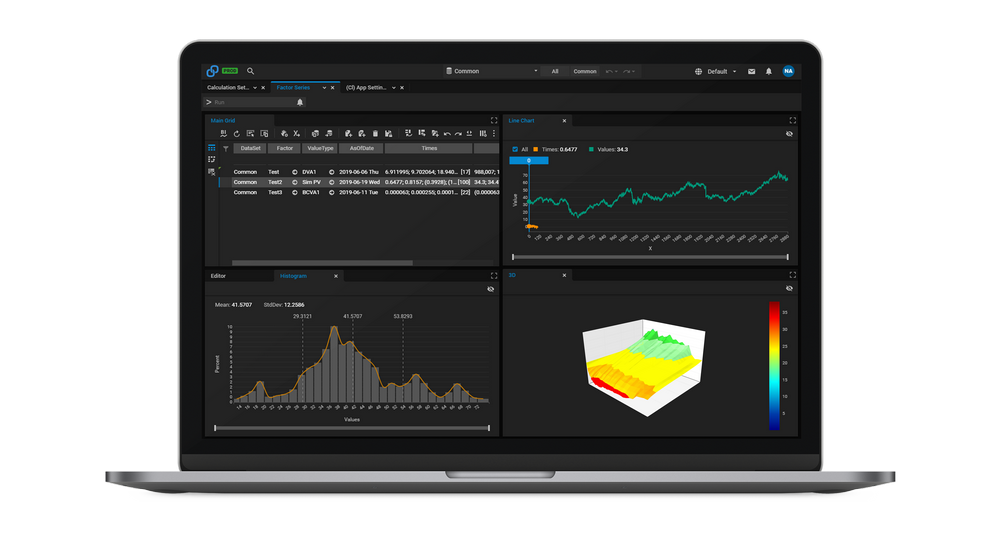

Real-Time Risk Analytics

Real-Time Risk Analytics

Use cloud or on-premises grid computing with the ability to run user-defined calculations on the cluster.

Comprehensive Reporting

Comprehensive Reporting

Full storage and customization of reporting capabilities based on HTML5 front-end technology.

BI Tools

BI Tools

Create interactive reports quickly and easily, drawing from multiple data sources.

Open Risk Architecture

Open Risk Architecture

Use CompatibL’s valuation and risk models, or easily integrate your own quant library with user-friendly APIs in C++, C#, Java, and Python.

- Overview

- Regulatory Frameworks

- Front-End

- Back-End

- Tools

- Analytics

- Collateral Modeling

- Advanced Features

Overview

- Comprehensive credit risk functionality for desk, regulatory, and fair value reporting

- PFE and exposure quantiles across time horizons under real world measure using either traditional or joint (Hull Sokol White) calibration

- Advanced market risk including instantaneous shocks, parallel/non-parallel shocks and twists, relative and absolute, bucketed/term structure scenarios, duration, convexity

- Historical and parametric VaR

- First/second-order greeks and cross gammas for all trade and portfolio level measures: delta, gamma, vega, skew, epsilon

- A wide selection of methodologies for the limits

- PnL attribution (including PnL explain and delta reports)

- What-if analysis

Regulatory Frameworks

Our risk management software supports:

- Basel III

- FRTB

- ISDA SIMM

- IRRBB

- SA-CCR

Front-End

Our risk management software has:

- Flexible and customized HTML5 user interface

- High-performance HTML5 pivot control with virtualized rows and columns

- Business intelligence (BI) module

- Data grid/tables with the ability to aggregate and apply vector functions on the fly

- SQL and NoSQL databases and data stores (Mongo, Redis, MS SQL Server, Oracle, etc.)

- Rich UI component library

- Excel add-in working with the front-end or standalone

Back-End

- Cloud-based solution for AWS, Azure and other cloud platforms

- Batch services for Kubernetes

- Distributed cache for parallel calculations based on Redis or MongoDB

- Electronic trading support

- Event monitor

- Formula engine and structured derivatives payoff script

- Messaging adapters for standard protocols including RabbitMQ, JMS, TIBCO

- Bloomberg and Reuters market data adapters

- Workflow manager

Tools

The risk management software provides multiple tools that enhance productivity and processes.

- Excel add-in

- Server-side Excel spreadsheet processor

- Export in multiple formats (Excel, PDF, XML, CSV and others)

- Source code and script editor with syntax suggestions (IntelliSense)

- Log analyzer

- Application deployment and monitoring services

- Automated testing tools

- Code generation tools

Analytics

- Real-time analytics strengthened with grid or cloud computing, which allows running user-defined calculations on the cluster

- Dynamic model calibration – a flexible framework to fine tune calibration of cross-asset models with IR, FX, Commodity, Inflation, Equity, Credit components based on trade attributes

- PFE and exposure quantiles across time horizons under real world measure using either traditional or joint (Hull Sokol White) calibration

- Governance reporting to verify calculation input including trade data, market data, front-office MtM reconciliation and risk contributors

- Calculations of XVAs based on a single platform allow to assess an incremental impact of a deal across the variety of adjustments while multiple calculations allow to run several reports simultaneously

- BI and reporting services offer exposure, simulation, and analytic price reporting solutions comprising optimized data cache, multiple data source types, report templates, aggregation categories, and interaction drill-down control

Collateral Modeling

- CSA modeling – advanced features to model the change of collateral through time, including dynamic initial margin

- Classical or advanced (Andersen–Pykhtin–Sokol) model for the margin period of risk (MPoR)

- Quantification of trade and margin flow settlement risk as part of the overall counterparty credit risk

Advanced Features

- Import trade, market and reference data from multiple trading and risk systems

- Fast American Monte Carlo for complex derivatives

- Consistent model calibration for both market scenarios and trade prices

- Advanced modeling of dynamic hedging and collateral rules

- Flexible framework for using an external model for market simulation

- Stress testing and drill-down based on business unit, instrument type, desk, position, maturity bucket or custom factors

- Batch processing and workflow orchestrator and combining automated (calculations, feeds, etc.) and manual (e.g. approvals) steps

- Standard out of the box desk, regulatory, and fair value reports and reports customization

Why CompatibL

Cloud or On-Premises Risk Management Project

Cloud or On-Premises Risk Management Project

Track record of delivery of enterprise risk projects running on premises or on CompatibL Risk Cloud.

Focus on Software Development for Banks

Focus on Software Development for Banks

15+ years of experience in delivering complex business requirements for desk and enterprise risk.

Award-winning Vendor in Risk Management

Award-winning Vendor in Risk Management

Other vendors do everything from mobile to IoT, but CompatibL’s sole focus is software development for banks and asset managers.

Our Customers Say