All business endeavors come with risks. A risk means an event that, if it occurs, may have undesired outcomes and impacts. Risk management offers a set of techniques and tools that allow us to identify, measure, and manage risks. But what is financial risk management and how is it giving investors the confidence they need to succeed?

Companies use various types of risk management techniques to identify and mitigate investment risks to their advantage, as well as to boost returns from investments and earnings from business activities via:

Types of Risk Management Techniques

Financial risk organizations have improved their analytical toolkits in extraordinary ways over the last several decades with cloud computing, nontraditional data, and machine learning (ML) capabilities.

The most crucial aspects of financial risk management today are the development of proper risk management strategies and finding ways to treat risks within these strategies. The most common strategies are avoidance, reduction, sharing, and retention of risks. Which risk management strategy to choose depends on the risk weight and severity of the risk, the amount of potential and actual losses and gains, and many other factors.

In general, assessing financial risk means not only determining the likelihood of the loss of an asset or investment, but also measuring a financial organization’s attitude and tolerance to the risk, as well as its capacity for risk within a certain period.

Moreover, risk assessment is about quantifying financial risks by applying such methods as value-at-risk (VaR) analysis, regression analysis, and scenario analysis. However, the pandemic has raised questions about the reliability of traditional risk models and highlighted the benefits of more advanced methods (such as ML).

Global Concerns about Financial Risk

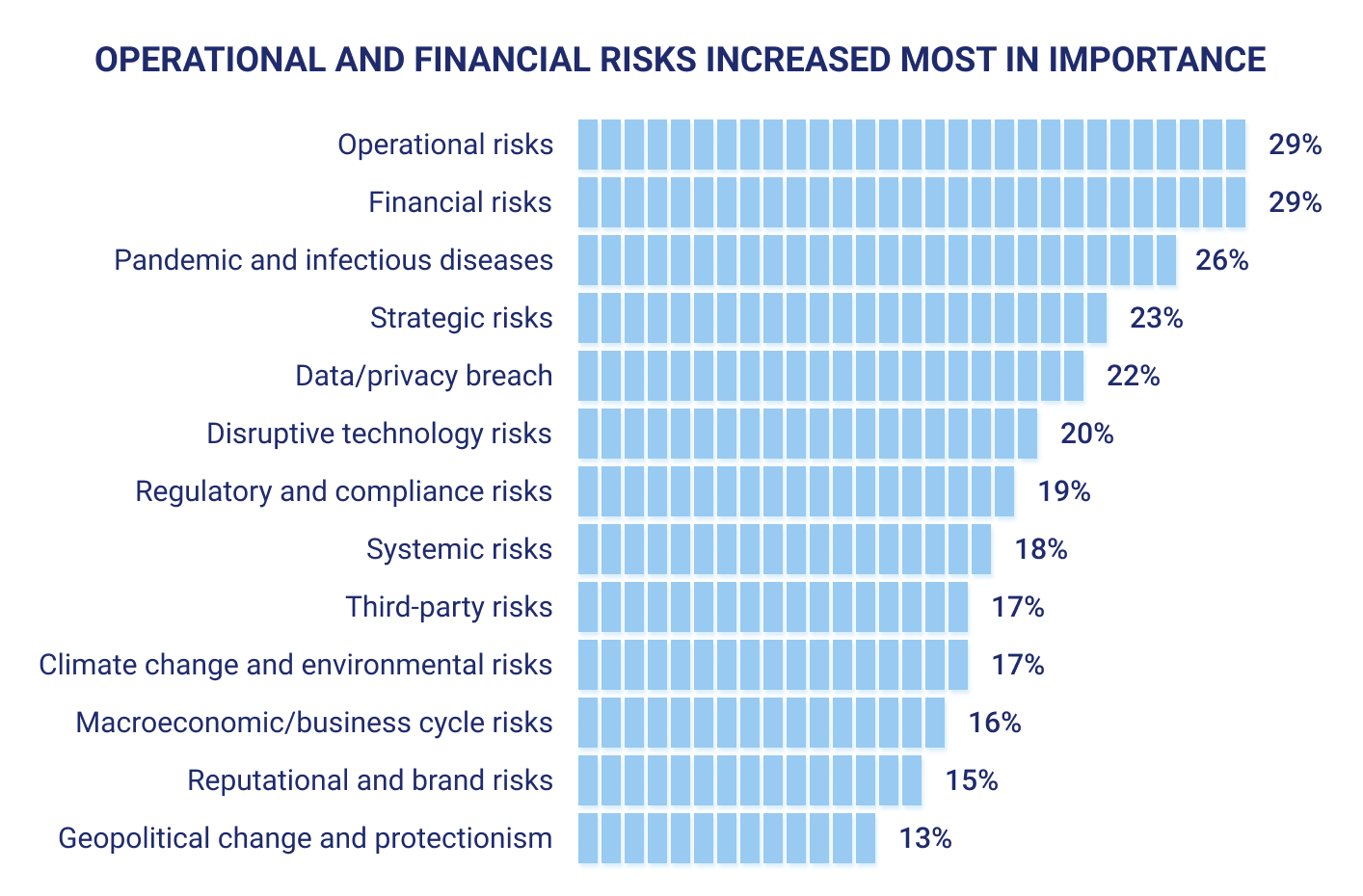

According to Accenture’s 2021 Global Risk Management Study, new risks have been emerging faster than ever and the risk landscape is becoming even more complex, volatile, and fast-paced. The most frequent response by risk leaders to questions raised in the study related to the importance of operational risk (a greater challenge for the software and platforms sector) and financial risk (of greater significance for the utilities and energy sectors).

Supply chain disruption and a dramatic increase in remote work during the pandemic exacerbated operational risks. Due to the economic uncertainty, financial risks were further aggravated by credit risk concerns. Additionally, cyberattacks, which could shut down critical business systems, have been on the rise.

However, even if organizations do everything they can to strengthen their operational resiliency, disasters can still happen. Business leaders need to have flexible and robust plans in place to respond when disasters strike.

Source: 2021 Global Risk Management Study, Accenture

An IMF article on climate change and financial risks underlines that climate change related risks are increasingly being factored in to policy making and regulatory requirements: damage to property, infrastructure, and land are just a few of the possible exposures that have implications for the financial sector.

In addition, the Green Swan paper published by the Bank for International Settlements warns that climate change could simply unleash “potentially extremely financially disruptive events” and the bankers are not capable of saving the world from such “Green Swan” events by themselves.

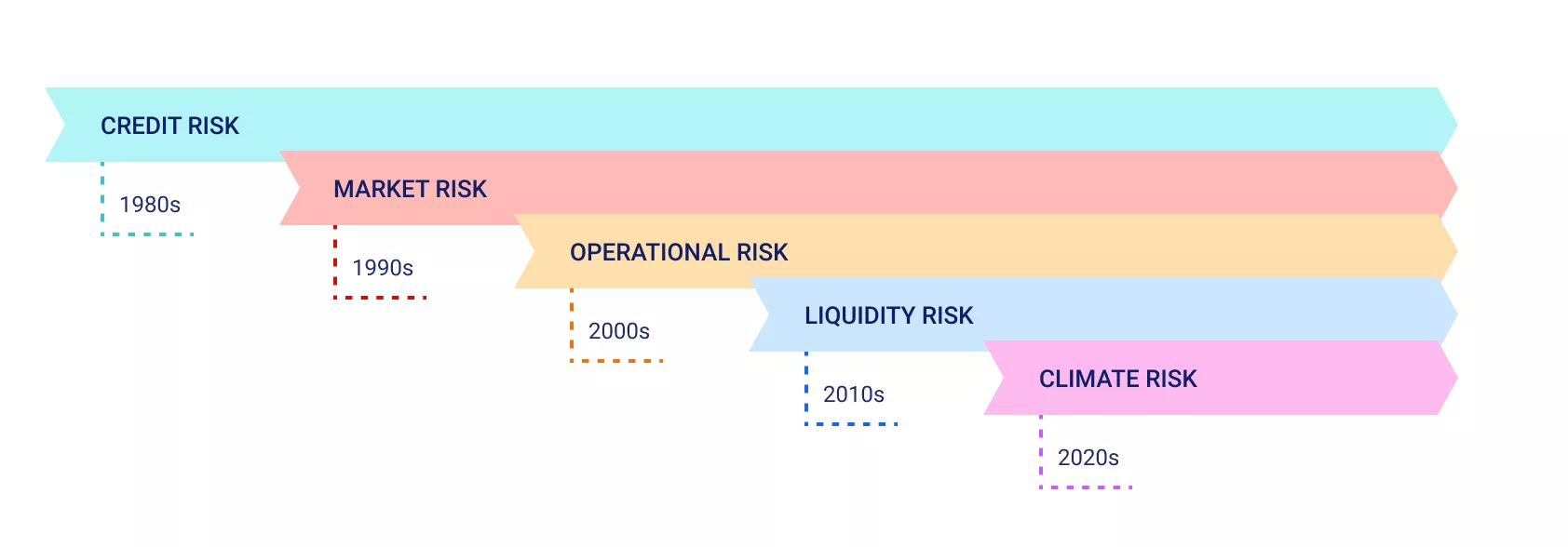

The Global Association of Risk Professionals offers the following overview of the regulatory evolution of financial risk management history:

Source: The Global Association of Risk Professionals

Although the regulatory focus has shifted to climate risk, it still embraces the four major risks: credit risk, market risk, operational risk, and liquidity risk. Investment risks, security, and breaks in business continuity may supplement the list of challenges faced by the capital and financial markets.

Environmental, Social, and Governance (ESG) factors are also taking center stage in the form of sustainability risks. Should these occur, such risks have negative impacts on a bank’s assets and reputation as well as its financial and earnings situation.

How to Manage Financial Risk

What is financial risk management like in highly regulated areas, such as banking, today? Regulators recognize the need for businesses to capture increasing amounts of data and produce progressively more accurate reports to maintain the continuity of financial institutions and banks in the face of financial risk. They stipulate the use of financial risk management software in their recommendations.

The benefits of such software are clear: automation, accuracy and relevancy, secure data processing, and real-time recording and updating of information allow businesses to keep pace with changes. In addition, certain types of risk management software also help to establish proper risk controls: the greater the consequences of the risk, the more stringent are the controls that should be applied.

Risk and control management software covers many aspects of risk management processes, from identifying a risk through to its assessment, mitigation, and monitoring. The features of risk management software include:

- Visual representation

- Evaluation techniques

- Control activities

- Analytics

- Reporting

- Risk monitoring

As a form of financial risk management, companies should be open to consulting third parties who are experts in mitigating exposures.

Risk Management Software: How to Choose a Financial Risk Management Vendor

For companies operating in a highly regulated environment or handling classified and confidential data, or those whose business is spread across multiple locations or exposed to potentially unfavorable market conditions, the smallest negligence or failure to comply or take proper measures may have the worst consequences.

Risk management software helps risk managers to identify risks and communicate them to their businesses. Moreover, it is important for protecting data, employees, customers, brands, and shareholders. But what does financial risk management look like for financial services organizations, e.g., banks, investment houses, lenders, finance companies, real estate brokers, and insurance companies?

For these organizations, there are many solutions on the market that are worth exploring. But how do Heads of Risk Management and Chief Risk Officers choose the right solution?

How to Choose a Financial Risk Management Solution

Start by answering these questions:

- What risk management framework applies to the business?

- Is the existing framework the best one?

- Should it be a cloud or on-premises deployment?

- What are the major features of the solutions offered in the market? And which of these are applicable to our business requirements?

- Should this solution be integrated with software the company already uses?

- What are the pricing options?

Once the big picture has been outlined, risk managers can start to evaluate their requirements and the types of risk management approaches to take. The chosen financial risk management solution must also align with business goals and the expectations of stakeholders. With this understanding, Heads of Risk Management and CROs can move to preliminary consultancies with vendors, check their credentials and certificates, and ask them for references.

Tips for CROs when talking with risk management software vendors:

- Is the solution scalable?

- What are the payment conditions?

- Who gets custody of the supplemented data once the company changes vendor?

- Is there any proof of concept?

At this point, risk managers should already have a clear picture of what they want or need and what their potential vendor is able to offer. Do not forget to agree on a detailed roadmap and deliverables, if any, with your software vendor before signing the deal.

At CompatibL, we offer solutions specifically tailored to our clients’ needs. By combining quant and engineering expertise into one team, CompatibL is highly effective at developing risk management software for the financial industry. In particular, our products allow our clients to enhance their risk management infrastructure and framework to improve the performance of their business, improve their risk management culture, and strengthen their risk management techniques.

Focus on Mitigation, not Elimination

The pace of change does not seem to be getting any slower. And risks are growing even more complex.

As stated in the World Economic Forum Global Risks Report 2022, there is undoubtedly a need for a multistakeholder approach to mitigating risks: leaders from businesses, governments, and nonprofit communities must come together to seek the best solutions.

Meanwhile, firms are supporting incentives to develop new technologies aimed at promoting sustainable finance and mitigating the impact of climate change. Many regulators are urging global coordination and more accurate evaluation of the long-term consequences of climate change on the financial outlook.

These are just few of the many global risk management initiatives. They are intended to raise concerns about the current impacts on capital and financial markets and raise awareness of the importance of good financial risk management.

The threats and risks to businesses continue to proliferate, but the combination of existing technology with new advances has the potential to solve them. To protect your organizations’ financial future it is essential to manage these risks.